Yesterday, the Tax Foundation released its 2017 State Business Tax Climate Index (SBTCI) that purports to show that West Virginia now has the 18th-best state business tax climate in the country, ranking better than any of our surrounding states. Policymakers and others should exercise caution in drawing any positive conclusions from the report since the index bears little to no relation to what businesses actually pay in taxes nor is it a good predictor of state economic growth, as economist Peter Fisher has summarized here. (The index also fails to consider the obvious point that taxes paid by businesses help provide the resources necessary to train their workers, move their product, and protect them from misfortune.)

For example, take West Virginia. West Virginia has seen its “business tax climate” go from 34th to 18th best from 2007 to 2017. The reason for this change has do with the major business tax cuts that were phased-in between 2007 and 2015. Altogether, the state reduced business taxes by at least $225 million annually in 2015. While this may have reduced business costs, it has led to large budget cuts to programs like higher education from which businesses directly benefit. What about business growth? Well, private-sector job growth has been abysmal. West Virginia had more private sector jobs in 2007 (619,000), than it does today (614,500).

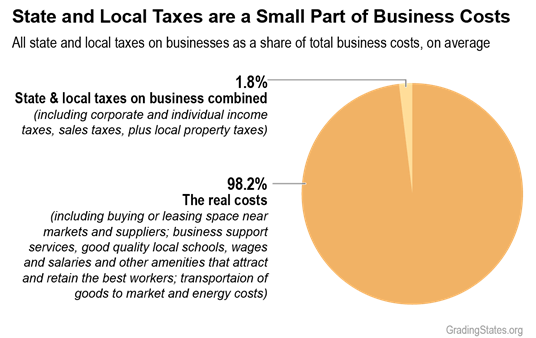

The central reason why indexes such as this one, and business tax levels in general, fail to predict growth is that they are a small cost of the doing business – usually less than 2 percent. Other factors, such as the cost of labor, transportation, utilities, and occupancy are usually much bigger considerations.

Rational profit-maximizing businesses would also consider the level of public provisions (e.g. good schools, roads, etc.), the quality of life, the supply of qualified workers, and other state and local policies. Businesses might also look to national tax policies and national economic conditions when looking to expand and make a profit. All of these other considerations cast doubt on the theoretical argument that state taxation alone will have a large impact on economic growth.

Policymakers in West Virginia would be wise to listen to what Minnesota’s Governor Mark Dayton’s office recently said about its unfavorable ranking in the Tax Foundation’s index: “The Tax Foundation has an anti-tax ideology and views lower taxes as desirable…For the past two years, Minnesota has ranked in the top five best states for business by CNBC, due to our highly-educated workforce, investments in infrastructure, and high quality of life with a lower cost of living, none of which the Tax Foundation factors into its rankings.”