For Immediate Release Contact: Caitlin Cook, 304.720.8682

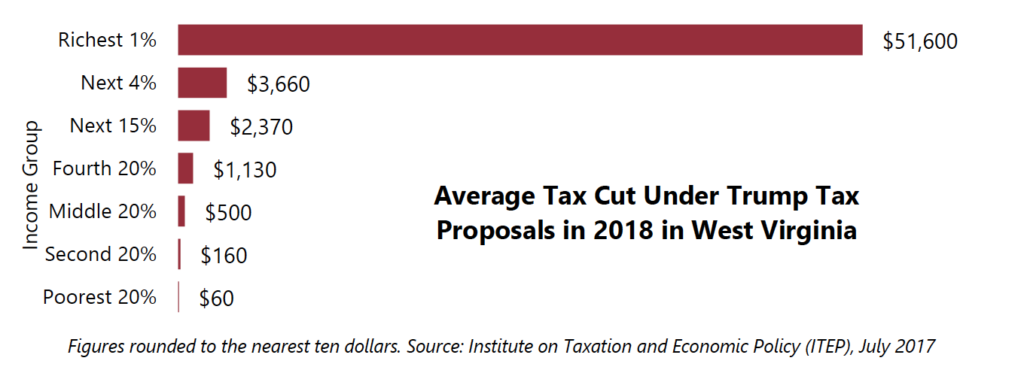

A new analysis from the Institute on Taxation and Economic Policy reveals a federal tax reform plan based on President Trump’s April outline would fail to deliver on its promise of largely helping middle-class taxpayers, showering 61.4 percent of the total tax cut on the richest 1 percent nationwide. In West Virginia, the top 1 percent of the state’s residents would receive an average tax cut of $51,600 compared with an average tax cut of $720 for the bottom 60 percent of taxpayers in the state. PDF news release.

“All too often, federal and state policymakers talk about tax cuts as though they don’t have consequences,” said Ted Boettner, West Virginia Center on Budget and Policy Executive Director. “But the truth is, these tax cuts that largely benefit the wealthy would come with a heavy dose of cuts to vital program and services. Reducing investments in health care, education, food assistance, disability insurance and other programs is too steep a price to pay just so the very rich can get a tax cut that is equal to three times more than the household income of ordinary working families.”