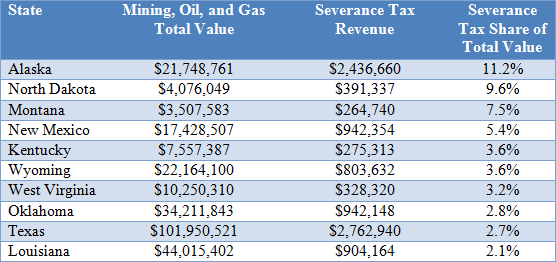

One idea we’ve championed in the past is the creation of a trust fund for economic development and diversification funded through an increase in West Virginia’s severance tax levied on coal and natural gas extraction. But would raising the severance tax make it too expensive to mine coal or drill for natural gas in West Virginia, and hurt the state’s economy? Let’s look at how West Virginia compares to other states.

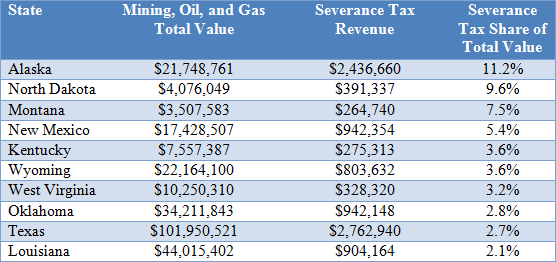

First we’ll look at which states rely on severance taxes. As the table below shows, it’s not surprise that the top severance tax states all are rich in coal, oil, gas, or all three. Alaska tops the list, with over 66% of state tax revenue coming from severance taxes. West Virginia comes in with over 7% of state tax revenue coming from its severance tax.

State Tax Revenue, 2007 (thousands)

Source: U.S. Census Bureau

So while West Virginia relies on the severance tax, it doesn’t do so to the extent of some other energy and natural resource intensive states. But which state actually taxes coal, oil, and gas the heaviest, and how does West Virginia compare? Instead of comparing the

statutory rate for each state, a more accurate way to compare is to calculate an effective rate for each state.

One way that can be done is by using data from the

2007 Economic Census (the most recent year available). One data item from the economic census is the

total value for shipments, and receipts for services for every industry, which, for the mining industry, would basically be the total value of all the coal, gas, and oil sold by the industry. By dividing total severance tax revenue by that number, you can come up with an effective severance tax rate for the mining industry.

Effective Severance Tax Rates, 2007

Using this method, West Virginia has an effective severance tax rate of 3.2%, well below the average of 5.2% for the top ten states. Alaska had the highest effective rate at 11.2%. Of the ten state’s most reliant on the severance tax, West Virginia ranked 7th for effective rate. West Virginia also had a lower effective rate than neighboring energy producer Kentucky, and a lower rate than the western states whose production is growing more competitive with West Virginia every year.

With West Virginia’s effective severance tax rate lower than several other highly productive energy resource states, it seems unlikely that a small increase in West Virginia’s severance tax rate would hurt production nor cause any economic harm. Further, most analysts believe that severance taxes are highly exportable, meaning that the tax burden falls mostly on out of state utility customers and shareholders. This is just one more reason why the state needs to create a WV Trust Fund with a modest increase in the severance tax. Without it, there is no guarantee that the state will benefit from natural resource production in the long-run.