Last week, the Pew Center on the States released a report that looks at the impact of the “fiscal cliff” on state tax revenues and spending programs. The report also includes a nice fact sheet on the impact to West Virginia.

On the revenue side, West Virginia, like several other states, is linked to the federal income tax code so expiring provisions within the “fiscal cliff” (e.g.expiration of 2001,2003, and 2009 tax cuts ) could increase state tax revenues in the state, including federal personal deductions in income taxes, business reductions in the corporate income tax, and the estate tax.

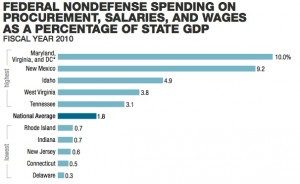

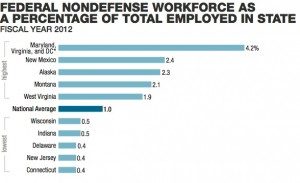

On the spending side, 18 percent of federal grants would be subject to the across-the-board cuts. This includes education programs, nutrition for low-income women and children, public housing, and other programs. In all, total federal grants subject to sequester made up 6.7 percent of West Virginia’s revenue in FY 201o. Spending cuts in federal spending on procurement, salaries and wages, will also impact West Virginia’s economy. In 2010, these items made up 5.2 percent of West Virginia’s GDP. West Virginia is particularly vulnerable to cuts in non-defense spending, as these two charts reveal.

While West Virginia could certainly use the revenue, its benefits would be dwarfed by cuts in federal spending that flows into the state.

In other news, Craig Griffith is stepping down as State Tax Commissioner. Griffith has been a real asset to the state on tax policy over the last couple of years. Let’s hope they find someone as competent and hardworking to fill the position.